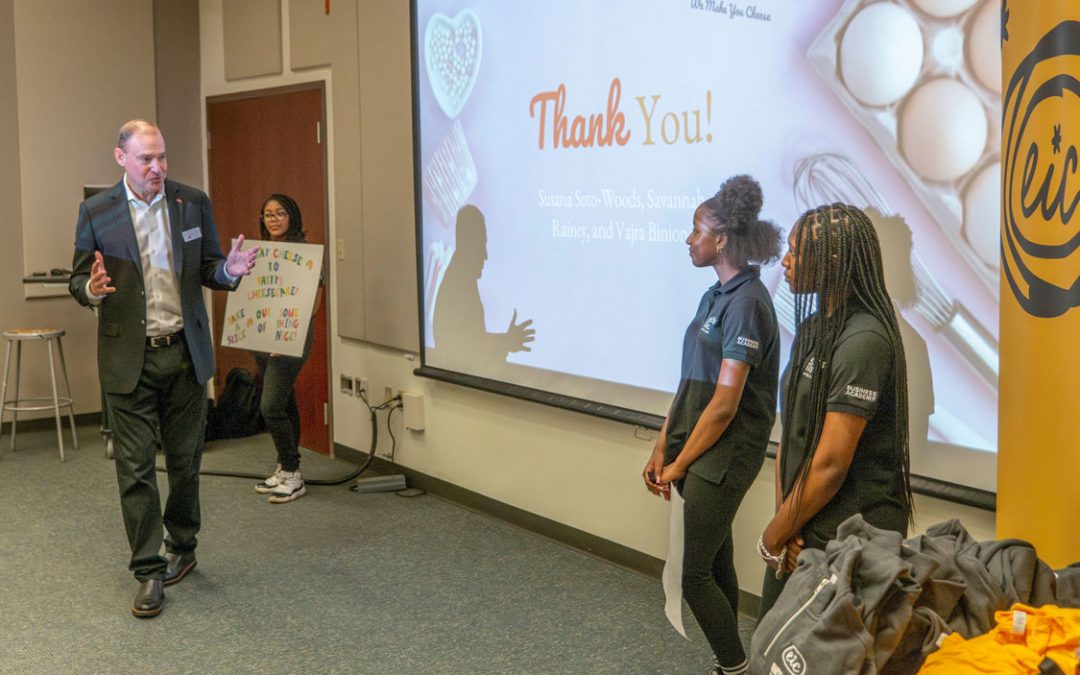

Michele Meckfessel, professor of accounting at UMSL, spoke with St. Louis Public Radio’s Jonathan Ahl about what working from home during the pandemic means this tax season. Mechfessel said most workers won’t be able to claim write offs for things such as internet, technology or furniture. (Photo by August Jennewein)

Amid a global health crisis, more people are working from home than ever. However, American workers who traded the office for the kitchen table or the spare bedroom shouldn’t expect a tax break this spring.

In the past, working from home usually meant write offs for things such as internet, technology and even furniture. The Tax Cuts and Jobs Act eliminated those deductions for most people in 2017, though.

Michele Meckfessel, professor of accounting at the University of Missouri-St. Louis, spoke with St. Louis Public Radio’s Jonathan Ahl about what working from home during the pandemic means this tax season.

Meckfessel specializes in capital market effects of financial reporting and income taxes and noted a few big takeaways for workers unsure about filing their 2020 return. She explained that work-from-home spaces utilized during the pandemic are not tax deductible for people who are not self-employed.

“Lots of us have purchased computers or chairs specifically for the purpose of being able to work from home,” Meckfessel said. “But unless you are self-employed, those items will not be deductible.”

She added that government tax officials see a home office as an extension of the company office.

Additionally, St. Louis workers should still expect to pay the city’s earnings tax even if they worked remotely outside of the city limits.

“Because you are operating remotely from an office that is located in St. Louis City, you are still liable for those local taxes related to St. Louis City,” Meckfessel said.

Meckfessel said the same logic applies to people who work in one state but have been working from home in another. For instance, those employed by Missouri companies who have been working from home in Illinois will still have payroll taxes withheld in Missouri.