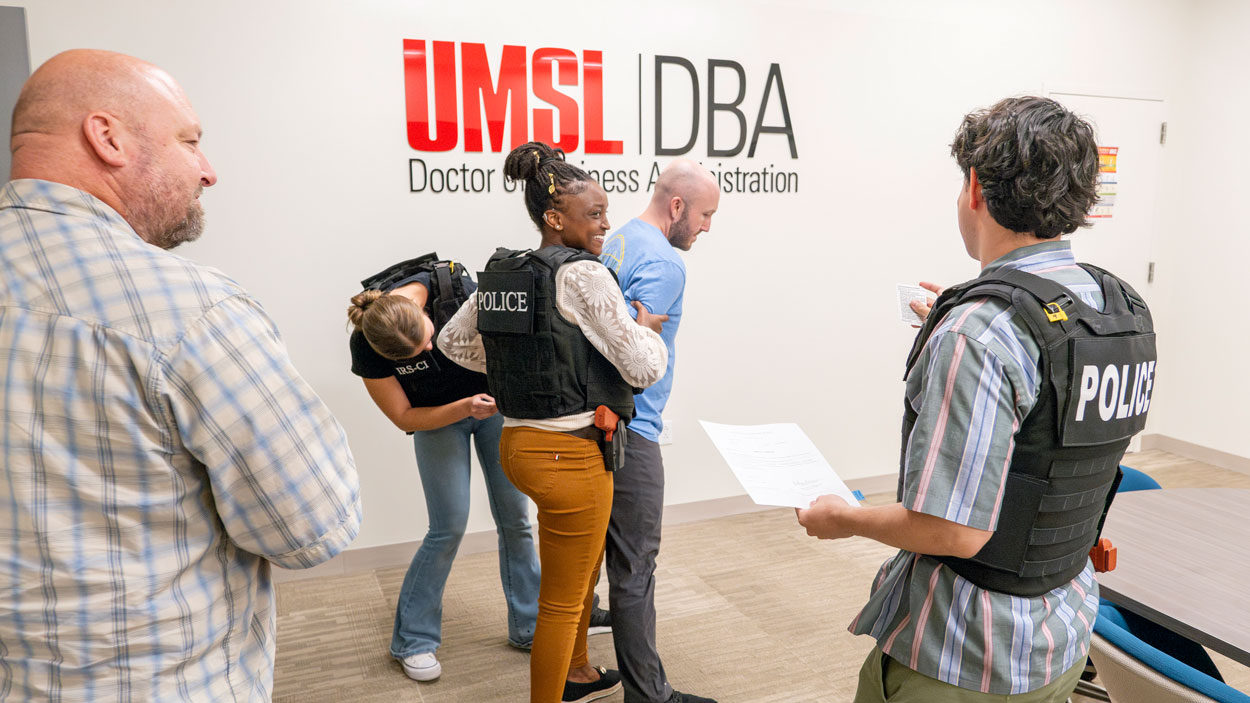

UMSL students (from left) Abby Burrows, Cyn Mungai and David Farnham “arrest” a suspect as part of the IRS-CI’s Citizen Academy last week at Anheuser-Busch Hall. (Photos by Derik Holtmann)

Assistant United States Attorney Gwendolyn Carroll has spent four years as the white-collar unit chief with the U.S. District Court for the Eastern District of Missouri, and she’s been a federal prosecutor for 15 years. She has presented cases to hundreds of grand juries and judges, but Friday in room 103 of Anheuser-Busch Hall, she presented a different type of case, one she’s very passionate about.

This was an informational and motivational recruiting pitch, part of the IRS Citizen Academy, a simulated experience put on by members of IRS Criminal Investigation’s St. Louis field office. The full-day event showed students at the University of Missouri–St. Louis what life would be like if they choose to pursue a career as a special agent with the IRS-CI unit.

“The honest reason I’m here is because we desperately need law enforcement agents,” Carroll told UMSL Daily after she finished her talk. “For any number of reasons, financial crime is rising, particularly in the Eastern District of Missouri, which is our jurisdiction. Communicating with people who are not yet in law enforcement, trying to encourage them about the value of this work, is really important because we need people to raise their hands and decide to be public servants.”

This is the second time the IRS-CI field office has presented the Citizen Academy at UMSL, following up on a successful event in April 2023. Beta Alpha Psi sponsored both events.

IRS-CI special agent Maria Mory (center) is an UMSL alum who participated in the Citizen Academy as an accounting student in 2023.

Maria Mory was one of the students who participated in the inaugural event on campus, and it definitely made an impression – so much so that this time around, she participated as a newly minted IRS-CI special agent. Mory, who graduated with a bachelor of accounting in December 2023, received her official job offer from the IRS in August and started five days before the 2024 academy.

“I’ve been able to experience both sides,” Mory said. “I was excited to see all the instructors again, and I’ve had so much fun talking with the students because I’ve been exactly where they’re at. Being able to help them with the process, explain what I went through, it’s been very exciting.”

Mory was one of close to 20 IRS-CI agents who participated in the event, which was facilitated by Supervisory Special Agent Travis Ardrey. Assistant Special Agent in Charge Melissa McFadden, the most senior person at the event, answered questions, dispensed advice and presented certificates to each of the students at the end of the program. A total of 14 students, primarily from the accounting department, participated in the Citizen Academy.

“The students were incredibly invested,” said Johnna Murray, an associate teaching professor of accounting in the College of Business Administration who helped bring the event to campus. “They were there from 9 a.m. until 3 p.m. They were asking questions and were really interested in hearing the agents describe each part of their work. Of course, it gets everybody excited to practice what they’ve learned.”

After Ardrey and McFadden presented an introduction to the IRS-CI unit, students were broken up into groups of three or four and given a case to pursue through the event, following the procedures and steps IRS-CI special agents use. They worked with special agents to review suspicious tax returns, they did interviews and interrogations – with special agents acting as accountants and suspects – and the final step was making the mock arrest, wearing bulletproof vests and carrying fake weapons.

UMSL students Lilly Houser, Nicole Mullins and Autumn Starnes listen to advice from an IRS-CI special agent before making their mock arrest.

“It was very informative and very all-inclusive,” senior Nicole Mullins said. “This is something that I’m interested in doing, which is one of the reasons I came to this event, but I don’t think I was really expecting how hands-on it was. I thought it was going to be more information and more just looking through the documents. I wasn’t expecting to do the interrogations, or interviewing the accountant and then the client, and then making the arrest.”

Mullins, who is co-vice president of Beta Alpha Psi, is studying in the Accelerated Master’s Program in accounting at UMSL. She’s on track to finish her undergraduate degree in December and will finish her master’s in 2025.

David Farnham, a transfer student who started at UMSL this semester, echoed the sentiment.

“More people should try it,” he said. “This was super informative. I’m going to look further into this as a result of going to this event, and I thought I had my plans more or less figured out. This is definitely cool. I didn’t know that it would be that far-reaching.”

On the schedule of events, Carroll spoke after the students finished the interrogations and before the mock arrests, emphasizing why she believes in the work the IRS-CI unit does, not only because of the importance of arresting criminals but the quality of the cases the agents deliver.

“I really cannot say enough things about the kind of work that we get from Internal Revenue Service agents in my office,” she told the students. “It’s tough to overcome the kind of mountain of evidence that an IRS investigation generates but every once in a while, someone decides to try and fight it. I don’t think we’ve ever lost a tax case we’ve finished in Missouri.”

Ardrey jumped in.

“There was one case years ago where the jury did not convict on the Title 26 charges, but did convict on the obstruction charges,” Ardrey said. “So, one out of all the cases we’ve done in the last 23 years, that’s a pretty good record.”

Carroll also emphasized the scope of crimes her unit prosecutes.

“There are very few federal crimes that don’t involve money,” Carroll said. “The kinds of murder cases we do are murder-for-hire cases where the motive is financial. Drug traffickers are not drug trafficking because it’s a game. They do it because of money. People commit tax crimes because of money. Human trafficking and child exploitation crimes are, at the end of the day, financial crimes. And the IRS’s special skill is finding, tracking and identifying how criminal proceeds have moved from people’s hands.”

She paused and looked at the students around the room.

“And you are in a room with the people who are best equipped and whose careers are devoted to finding that money.”

Assistant United States Attorney Gwendolyn Carroll spoke with the students about the importance of the work done by IRS-CI agents.

Ardrey spoke to the importance of a solid relationship between agents and Carroll’s department.

“In my career, I don’t think that I have ever worked with an AUSA that was not on board with what I was trying to accomplish,” he said. “That working relationship is so key. She doesn’t want any surprises from me, and I don’t want any surprises from her. That communication between the U.S. attorney’s office and us, that is so key in all our investigations.”

When it was finally time to make the arrests, the students donned the vests and grabbed their fake weapons while the special agents gave them last-minute instructions and advice.

Farnham’s group, with Cyn Mungai and Abby Burrows, went down the hall, where their suspect – played by a special agent – was waiting in a room.

“I was going to put the cuffs on, but then, just situationally, we had to change up,” Farnham said. “I ended up being the Miranda Rights-giver, as well as providing some backup potential use of mock lethal force.”

Mullins and her group moved to arrest their suspect in the corner of 103. She understood her assignment, which was to quickly and confidently read suspect “Todd Smith” his Miranda Rights.

“The agent talked me through it before reading the rights,” Mullins said. “He said the suspect is going to probably be the same way as when you did the interview. So I was reading the rights as fast as possible because anything they say, if they confess to something before you read them their rights, that can affect the trial.”

Mullins read authoritatively, undaunted by the protests of the suspect.

“I’m just here to finish the Abernathys’ bathroom!” the agent/suspect said. “I didn’t even take that $20 bill on the table!”

As Mullins was finishing her task, fellow students Lily Houser and Autumn Starnes handcuffed Smith. The Abernathys’ bathroom project would have to wait.