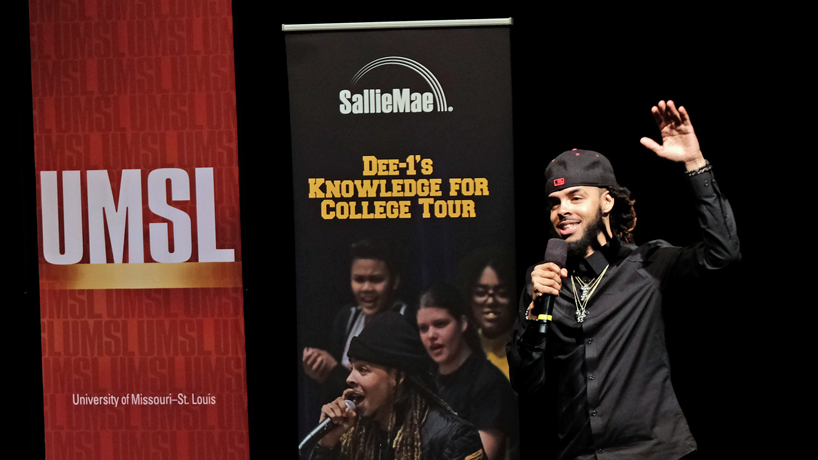

Hip-hop artist Dee-1 spoke and performed last Tuesday at the Blanche M. Touhill Performing Arts Center during a kickoff event for Triton F.L.Y. Week – Financial Literacy for You. (Photos by August Jennewein)

David Augustine Jr. has built a career as a hip-hop recording artist under the stage name Dee-1 with more than 49,000 followers on Twitter and 197,000 on Instagram.

But long before he broke through in the music industry, going on nationwide tours and ultimately signing with RCA Records, he was a kid from humble beginnings in the Ninth Ward of New Orleans looking to education as means of improving his future.

He has partnered with consumer banking company Sallie Mae and gone around the country sharing lessons he learned about how to afford a college degree, which in his case led him to a job as a middle school math teacher before he was discovered.

Juniors and seniors from area high school districts, including Hazelwood and Riverview Gardens, join UMSL students listening to Dee-1 speak and perform during the Triton F.L.Y. Week kickoff event.

Dee-1 spoke and performed last Tuesday at the University of Missouri–St. Louis Blanche M. Touhill Performing Arts Center to kick off Triton F.L.Y. Week – Financial Literacy for You – organized by members of the Office of Student Financial Aid and the Office of Admissions.

“I don’t know how many of y’all can relate to this, but I didn’t grow up rich,” he told an audience of a few hundred high school and college students shortly after taking the stage in the Anheuser-Busch Performance Hall. “My people didn’t really have much money, so when it came time to go to college, I had to make a decision, which was how am I going to pay for school.”

Dee-1 shared the merits of applying for loans and grants – free money that can help make a degree more attainable.

He also offered lessons on how to use loans wisely, taking out only the money a person needs and making certain the person is choosing a school that is affordable for them and their intended career.

Dee-1 implored the students – including high school juniors and seniors from nearby school districts such as Hazelwood and Riverview Gardens – to follow through with their education.

“Going to college does not change your life,” he told the students. “Graduating college does change your life.”

Making smart financial decisions now can carry over into adulthood, Dee-1 said. He shared a story about the first thing he did when he signed his record deal.

“All these people put pressure on me to buy this, buy this, buy this,” Dee-1 said. “But if as soon as you get money, you spend it all on these name brands, then you’re broke again. So the first thing I did with my money – nobody told me to do this – the first thing I did with my money is I finished paying off all my student loans that I took out to go to college. Because you’re not really a boss if you’re still in debt and if you owe people.”

That was the inspiration for Dee-1’s hyper-energetic 2016 single, “Sallie Mae Back,” which he later performed to loud cheers while joined on stage by some of the students dancing along.

Throughout the course of Tuesday’s program, Dee-1 passed out gift cards to students who asked or answered questions.

Dee-1 also helped celebrate the winners of 11 scholarships – two $500 awards each from Sallie Mae and Commerce Bank and seven $1,000 scholarships from UMSL.

An event Thursday afternoon in the Student Government Association Chambers in the Millennium Student Center looked more deeply at financial decision-making and provided information about how to pay off student loans.

Scott Wolla, the economic education coordinator for the Federal Reserve Bank of St. Louis, led students through a series of activities to help them with budgeting and understanding cash flows.

William Shaffner, the director of business development and government relations for the Missouri Higher Education Loan Authority, explained different loan repayment options available for students and discussed things they need to look out for when they finish school.

“I learned a lot, especially about student loans,” said Nyla Reed, a freshman studying social work who attended the session along with other students in her University Studies seminar course. “A lot of this is stuff that we don’t know, and me being a first-generation student, my parents don’t know this stuff either. So I do think it’s valuable, especially for those students who don’t have people who know the information already and are able to share it with them.”

That was the goal of Triton F.L.Y. Week.

“We do a good job preparing students academically for life after college,” said Chris Bowen, assistant director in UMSL’s Office of Student Financial Aid. “We want to make sure that we’re also preparing them to be financially successful so they’re able to live a life that they want and not be burdened by debt.”

Reed was among four additional students to receive scholarships at Thursday’s event.

Tony Georges, the director of student financial aid, hopes to provide similar programming for students next year while building an even bigger audience.

“This is our start,” he said. “We hope that this will grow, like most programs. We’ll continue to do what we can to get more students to come and provide experts like we did to come in and deliver the information needed.”