From Jugging School, an Internship, and Entrepreneurship, DeNae Howard has her hands full

Share A work/life balance is hard enough to juggle as a student, but student-entrepreneur DeNae Howard likes to stay busy. DeNae is a graduate student in the University of Mi

Paula Penagos is Pushing Boundaries and Finding Her Way in the Ph.D. in Supply Chain Analytics Program

SharePaula Penagos found her place at the University of Missouri-St. Louis in a unique way. Paula is a current Ph.D. student in the Supply Chain Analytics program. She began her ed

Triple Alumna Layne Paubel Appreciates the Value of an UMSL Degree

ShareThe name “Paubel” is well-known on the University of Missouri-St. Louis campus. The family has produced generations of graduates and a few generations are continuing their

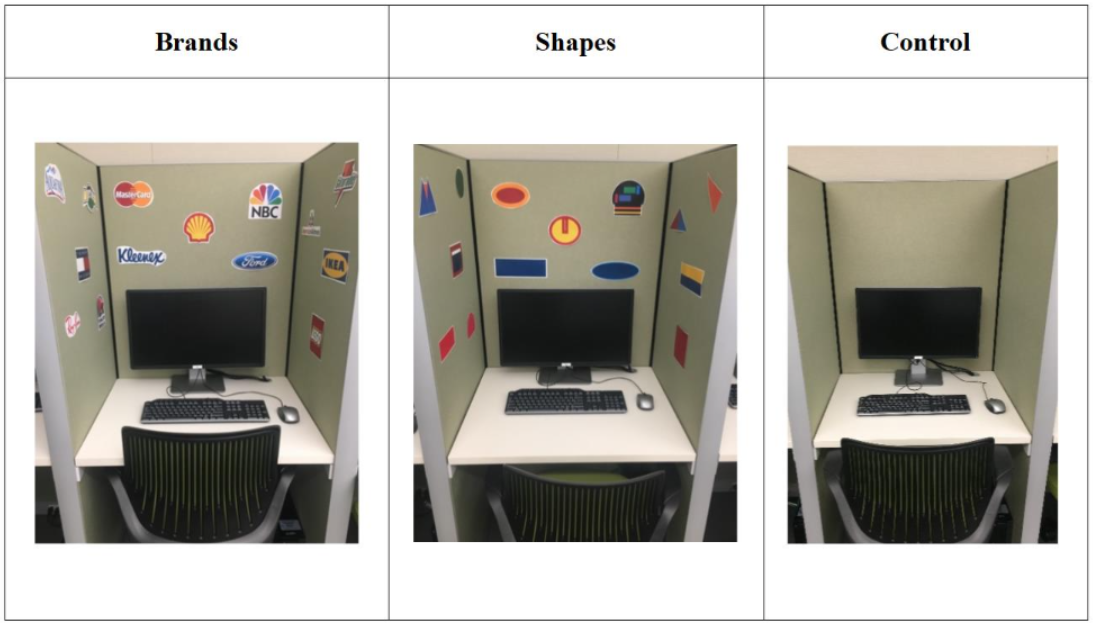

Assistant Professor Dan Grossman Discovers Interesting Findings Between Brand Exposure and Preferential Decision Making

ShareWhether you are walking down the street, driving your car, listening to the radio, or watching television, you are being marketed to, you are surrounded by advertisements. Bra

Finance Graduate TaShauna McAllister Turns An Internship Into A Permanent Position

ShareWritten By: Eboni Valentine Many college graduates have one goal upon graduation, landing a job in their field. Some students struggle and experience “post-graduation depres

UMSL Student Zoe Phillips on How to Become an Influencer

ShareWritten By: Zoe Phillips, UMSL Graduate 2023 An influencer is more than posting a picture with a company logo. Being an influencer is believing in the product and BEING the br

The International Business Institute hosted its 10th annual International Case Competition

ShareWritten by: Eboni Valentine The International Business Institute hosted its 10th annual CUIBE International Case Competition on April 20-22. Led by the Director of the Interna

THE FUTURE OF AI AND MARKETING PANEL at MDMC

ShareWritten by: Nathan Jacquemin On April 18th, 2023, the Midwest Digital Marketing Conference (MDMC) produced by UMSL Business took place at the Touhill Performing Arts Center. T

From Niche to Network: Podcasting with Vernon Ross

ShareWritten By: Emma Wolf Recently UMSL Business students Isaac Baker and Blake Iliff sat down with Vernon Ross, founder of Enterprise Podcaster. Enterprise Podcaster is an

UMSL Students sat down with DemandJump

Share Written By: Emma Wolf In March, UMSL students Nathan Jacquemin and Emma Wolf got to sit down with some of DemandJump’s best, Ryan Brock who serves as the Chief Soluti